Monte Carlo simulation and application

Content

- Category: About MonteCarlo-simulation

- Resources: at GitHub

- Project URL: Go to the project

- The source cide for the MOnte carlo simulation and it's applications can be found at Github repository.

Details about this repository

Monte Carlo simulation is named after the famous Monte Carlo Casino in Monaco, which is known for its games of chance. It is a computational technique that uses random sampling and statistical analysis to model and solve problems. By repeatedly sampling from probability distributions, Monte Carlo simulation allows us to estimate the behavior of complex systems or processes.

Monte Carlo simulations and Machine learning algorithms

- Monte Carlo simulations are a class of computational techniques that use random sampling to approximate and analyze complex systems or problems.

- While Monte Carlo simulations themselves are not typically considered machine learning algorithms, they can be combined with machine learning techniques to enhance their capabilities.

- It's important to note that the specific choice of machine learning algorithms in Monte Carlo simulations depends on the nature of the problem, the available data, and the objectives of the simulation.

- Different algorithms may be more suitable for different scenarios, and their selection should be based on careful analysis and experimentation.

Examples

Python Jupyter notebooks can be found at my Github repository. I have started with simple examples on: Then applied the monte carlo simulation to the financial sector. A short summary about it is avaliable at: website.Monte Carlo Simulations for Risk Analysis and Finance

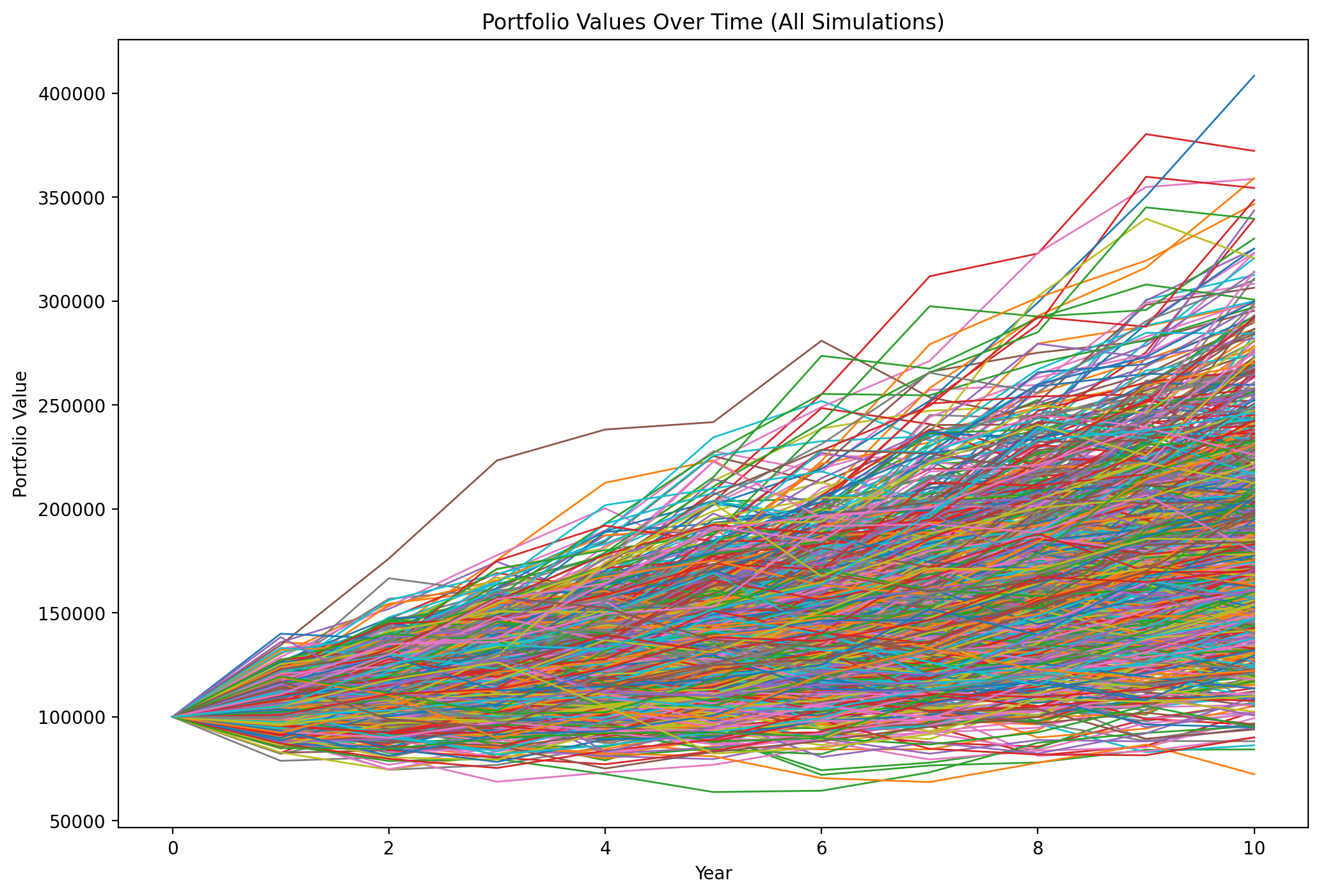

In this GitHub repository, a collection of Jupyter Notebooks and Python scripts showcases an in-depth exploration of risk analysis and finance using Monte Carlo simulations. A range of topics, providing insights into understanding and managing different types of risks in financial contexts.- Risk analysis:Focuses on general risk analysis in finance, exploring key concepts and methodologies.

- Credi-Risk: Delves into credit risk assessment, a critical aspect of financial risk management.

- Market-RiskExplores market risk, offering insights into market dynamics and risk evaluation.

- Portfolio Risk:Examines portfolio performance, considering the dynamics of various asset classes.

- Adani-share EDA analysis:Analyzes the risks associated with investing in Adani shares, providing practical examples.

- Broader context: Utilizes Monte Carlo simulation for risk analysis in a broader financial context. Further extends the application of Monte Carlo simulations to study specific financial scenarios.